Promising 2024 lures

Growth potential

Namibia's economy is expected to remain resilient this year, says Salomo Hei, managing director of High Economic Intelligence.

Salomo Hei - Risks persist in the domestic outlook, including uncertainties in the investment environment and policy certainty, slow progress in power generation, growing debt, global developments, high living costs, expensive key imports, water supply interruptions affecting mining, and the persistent threat of drought.

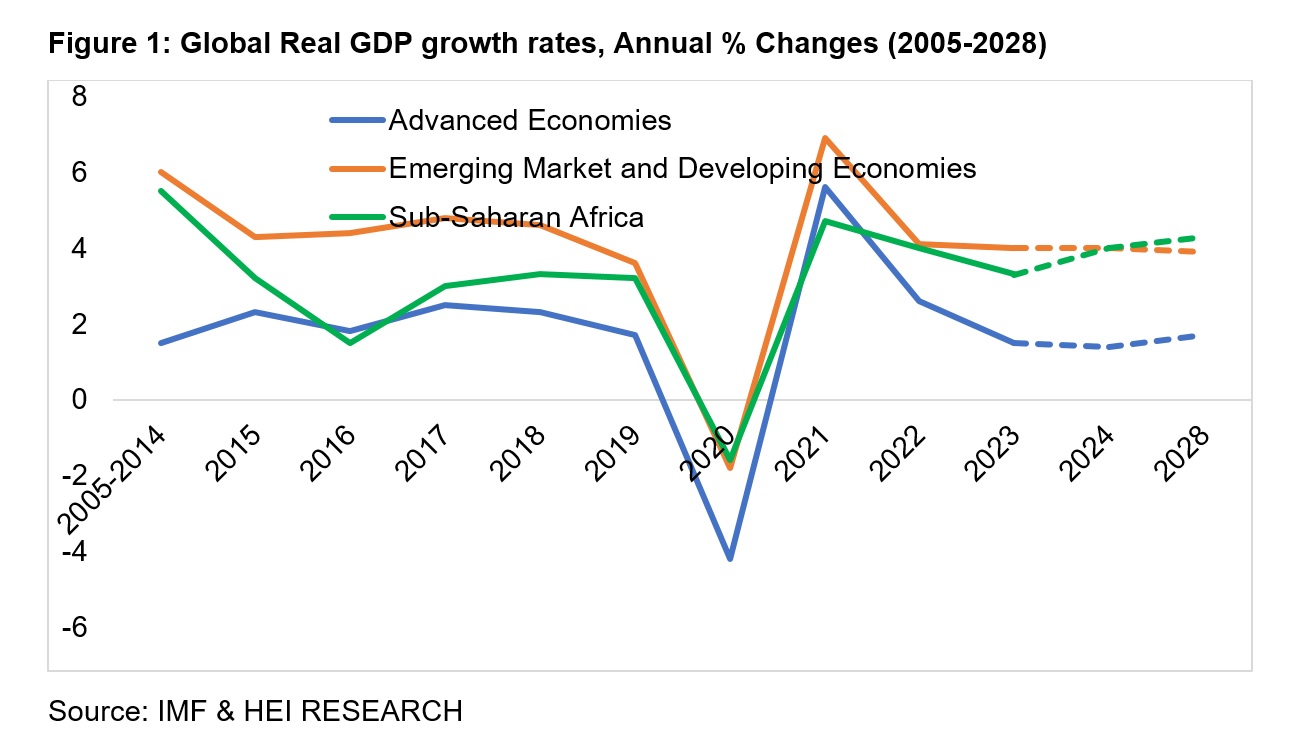

Despite these challenges, the projected trajectory for 2024 appears promising, supported by strategic initiatives, financial commitments and positive performance in key sectors, contributing to Namibia's overall economic resilience and growth potential.

Looking ahead, the anticipated growth trajectory is supported by the continuous positive performance in primary industries, especially the mining sector, driven by oil and gas exploration and improvements in the agriculture sector, particularly in livestock marketing.

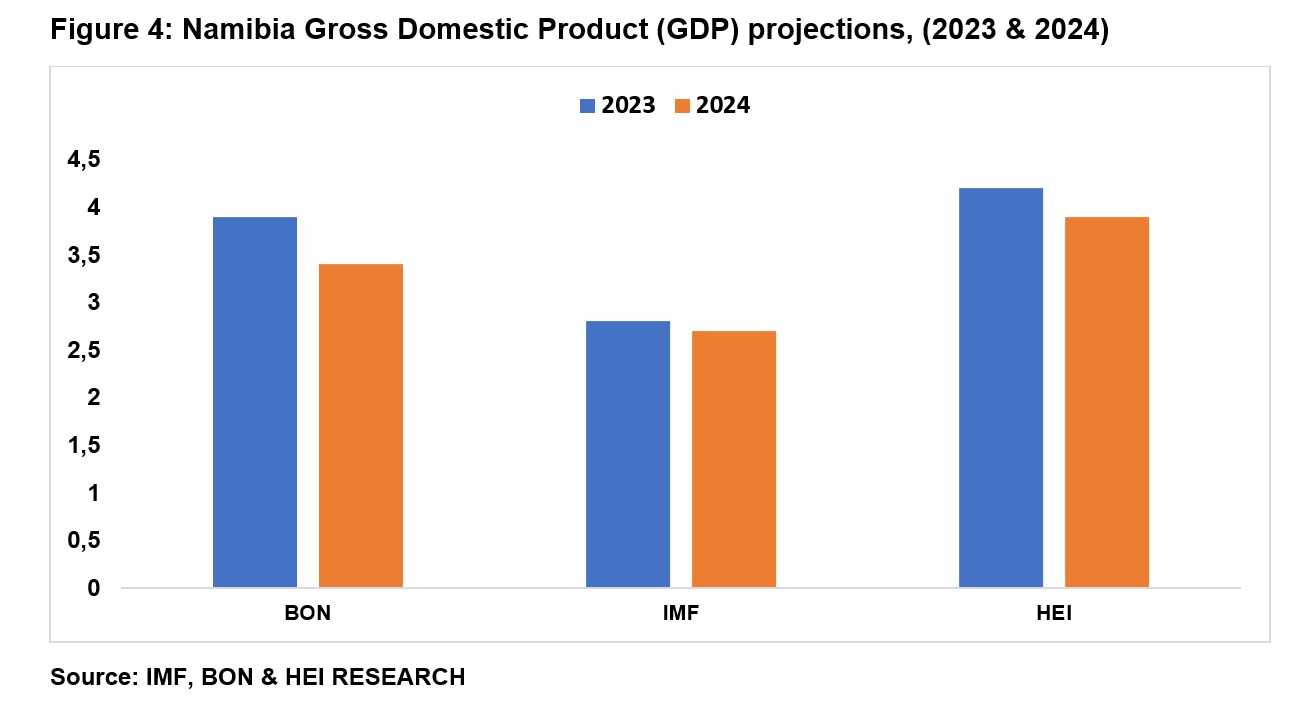

Projections indicate a stronger economic performance than the estimated 4% gross domestic product (GDP) growth in 2023, with expectations that 2024 will likely perform similarly, if not better, than 2022.

The mining and quarrying sector is expected to maintain its leading position, although a slowdown in the diamond mining category is anticipated. The oil and gas industry, particularly in the Orange Basin, continues to show promise for future prosperity.

Increased government spending is anticipated to boost certain industries, including administration, defense, education and potentially construction, though not to levels that would bring it back to positive territory.

Mining

We expect mining production to continue on a slow upward trend primarily due to reduced growth in diamond mining and other mining and quarrying dampened by low production stemming from declining diamond international prices.

The uranium mining subsector is expected to continue to recover from water supply interruptions that led to mines adjusting their production targets for the year upwards.

Despite challenges such as water supply constraints and higher input costs, we anticipate the uranium mining sector to grow at a healthy rate in 2024 as mines are constructing onsite water storage facilities to deal with future water crises.

Increased exploration investment into critical minerals and project pipelines to increase access to mineral resources and reserves remain crucial.

The metal ores sub-sector is expected to remain in positive territory in 2024 attributed to higher production from the gold subsector. Higher production volumes for gold are due to higher-grade ore mined from all mines in operation.

Other mining and quarrying activities (which include oil exploration) are expected to remain positive trajectory for the fourth quarter of 2023 and in 2024 due to stronger performance, buoyed by exploration activities under oil and gas sectors.

Construction

The construction sector in Namibia has faced significant challenges, primarily due to the government's fiscal consolidation and the lack of substantial spending on infrastructure projects since 2015.

However, there is optimism for an upturn in the construction sector as several key developments are expected to unfold.

Firstly, the initiation of green hydrogen pilot projects is anticipated to contribute positively to the construction sector. Additionally, a noteworthy agreement is expected to be signed between the Namibian ministry of finance and public enterprises and the German Development Bank (KfW), securing a concessional loan of nearly N$1.03 billion (approximately 50 million euro) for the financing of two wastewater treatment plants.

In October 2023, the Namibian government also approved a loan of N$196.43 million for the implementation of the second phase of the Transport Infrastructure Improvement Project (TIIP). This financial injection is poised to stimulate construction activities related to transportation infrastructure.

Furthermore, a significant boost to the construction sector is anticipated with the commencement of the construction of a 54 MW/54 MWH utility-scale battery energy storage system.

This project, led by the Chinese state-owned Shandong Electrical Engineering & Equipment Group (SDEE) and Zhejiang Narada Power Source joint venture, is set to begin next month. The system is expected to play a crucial role in advancing Namibia's energy infrastructure.

Despite the challenges faced by the construction sector in recent quarters, the outlook for 2024 appears promising with various strategic initiatives and financial commitments on the horizon. These developments are poised to rejuvenate the construction sector and contribute to economic growth in Namibia.

Agriculture

The sector showed resilience in 2023 with a strong performance recorded during the third quarter of 2023. The sector is expected to remain resilient in 2024, owing to better rainfall for crops and improved rangeland conditions for livestock farmers.

However, farmers are encouraged to continue diversifying their farming operations to minimise the risk of climatic, sectoral or economic shocks on production output and sales.

Investments in the agriculture sector are essential to boost productivity, precisely focusing on technological change and climate-resilient production techniques.

Tourism

Tourism’s trajectory remains optimistic, setting the stage for continued growth in 2024. Key to this positive outlook is the sustained positive sentiment surrounding national occupancy rates.

The consistent upward trend in these rates is expected to drive an increased demand for accommodation services. This surge in demand is not only reflective of recovering confidence in the tourism sector but also indicative of a broader resurgence in the hospitality industry.

We anticipate that the demand for both domestic and international travel will continue to exhibit positive momentum. This sustained enthusiasm for travel is expected to be a significant catalyst in the sector's ongoing recovery.

The confluence of improving economic conditions, increased traveller confidence, and a rebound in global tourism trends positions Namibia's tourism sector on a trajectory of resilience and growth.

Despite the challenges faced, the tourism sector in Namibia remains resilient, with the groundwork laid for a robust recovery in 2024 and beyond.

The positive performance indicators, including rising occupancy rates and growing travel demand, underscore the sector's ability to adapt and thrive in the face of adversity.

As the broader economic landscape stabilizes, the tourism sector is poised to play a pivotal role in contributing to Namibia's overall economic revitalisation for 2024 and beyond.

Wholesale and retail

The prevailing high prices for consumables and high interest rates are expected to continue exerting a downward pressure on consumer spending in 2024.

The sector is, however, expected to perform better in the medium term as construction activities linked to oil mining and green hydrogen projects gain momentum.

Financial services

We anticipate a continuation of moderate growth for the sector throughout 2024.

This projection is underpinned by the expected sustained positive momentum in total deposits and private claims.

As economic conditions stabilise, it is envisaged that the banking sector will play a pivotal role in facilitating financial activities and contributing to overall economic growth.

SIT ASB IN ‘n KASSIE

Key risks to the positive domestic outlook include:

• Fluctuations in commodity prices

• Uncertainties related to elections

• A possible recession in the South African economy

• Continued uncertainty over the investment environment

• Slow progress on power generation

• Growing debt

• Global developments

• High cost of living

Despite these challenges, the projected trajectory for 2024 appears promising, supported by strategic initiatives, financial commitments and positive performance in key sectors, contributing to Namibia's overall economic resilience and growth potential.

Looking ahead, the anticipated growth trajectory is supported by the continuous positive performance in primary industries, especially the mining sector, driven by oil and gas exploration and improvements in the agriculture sector, particularly in livestock marketing.

Projections indicate a stronger economic performance than the estimated 4% gross domestic product (GDP) growth in 2023, with expectations that 2024 will likely perform similarly, if not better, than 2022.

The mining and quarrying sector is expected to maintain its leading position, although a slowdown in the diamond mining category is anticipated. The oil and gas industry, particularly in the Orange Basin, continues to show promise for future prosperity.

Increased government spending is anticipated to boost certain industries, including administration, defense, education and potentially construction, though not to levels that would bring it back to positive territory.

Mining

We expect mining production to continue on a slow upward trend primarily due to reduced growth in diamond mining and other mining and quarrying dampened by low production stemming from declining diamond international prices.

The uranium mining subsector is expected to continue to recover from water supply interruptions that led to mines adjusting their production targets for the year upwards.

Despite challenges such as water supply constraints and higher input costs, we anticipate the uranium mining sector to grow at a healthy rate in 2024 as mines are constructing onsite water storage facilities to deal with future water crises.

Increased exploration investment into critical minerals and project pipelines to increase access to mineral resources and reserves remain crucial.

The metal ores sub-sector is expected to remain in positive territory in 2024 attributed to higher production from the gold subsector. Higher production volumes for gold are due to higher-grade ore mined from all mines in operation.

Other mining and quarrying activities (which include oil exploration) are expected to remain positive trajectory for the fourth quarter of 2023 and in 2024 due to stronger performance, buoyed by exploration activities under oil and gas sectors.

Construction

The construction sector in Namibia has faced significant challenges, primarily due to the government's fiscal consolidation and the lack of substantial spending on infrastructure projects since 2015.

However, there is optimism for an upturn in the construction sector as several key developments are expected to unfold.

Firstly, the initiation of green hydrogen pilot projects is anticipated to contribute positively to the construction sector. Additionally, a noteworthy agreement is expected to be signed between the Namibian ministry of finance and public enterprises and the German Development Bank (KfW), securing a concessional loan of nearly N$1.03 billion (approximately 50 million euro) for the financing of two wastewater treatment plants.

In October 2023, the Namibian government also approved a loan of N$196.43 million for the implementation of the second phase of the Transport Infrastructure Improvement Project (TIIP). This financial injection is poised to stimulate construction activities related to transportation infrastructure.

Furthermore, a significant boost to the construction sector is anticipated with the commencement of the construction of a 54 MW/54 MWH utility-scale battery energy storage system.

This project, led by the Chinese state-owned Shandong Electrical Engineering & Equipment Group (SDEE) and Zhejiang Narada Power Source joint venture, is set to begin next month. The system is expected to play a crucial role in advancing Namibia's energy infrastructure.

Despite the challenges faced by the construction sector in recent quarters, the outlook for 2024 appears promising with various strategic initiatives and financial commitments on the horizon. These developments are poised to rejuvenate the construction sector and contribute to economic growth in Namibia.

Agriculture

The sector showed resilience in 2023 with a strong performance recorded during the third quarter of 2023. The sector is expected to remain resilient in 2024, owing to better rainfall for crops and improved rangeland conditions for livestock farmers.

However, farmers are encouraged to continue diversifying their farming operations to minimise the risk of climatic, sectoral or economic shocks on production output and sales.

Investments in the agriculture sector are essential to boost productivity, precisely focusing on technological change and climate-resilient production techniques.

Tourism

Tourism’s trajectory remains optimistic, setting the stage for continued growth in 2024. Key to this positive outlook is the sustained positive sentiment surrounding national occupancy rates.

The consistent upward trend in these rates is expected to drive an increased demand for accommodation services. This surge in demand is not only reflective of recovering confidence in the tourism sector but also indicative of a broader resurgence in the hospitality industry.

We anticipate that the demand for both domestic and international travel will continue to exhibit positive momentum. This sustained enthusiasm for travel is expected to be a significant catalyst in the sector's ongoing recovery.

The confluence of improving economic conditions, increased traveller confidence, and a rebound in global tourism trends positions Namibia's tourism sector on a trajectory of resilience and growth.

Despite the challenges faced, the tourism sector in Namibia remains resilient, with the groundwork laid for a robust recovery in 2024 and beyond.

The positive performance indicators, including rising occupancy rates and growing travel demand, underscore the sector's ability to adapt and thrive in the face of adversity.

As the broader economic landscape stabilizes, the tourism sector is poised to play a pivotal role in contributing to Namibia's overall economic revitalisation for 2024 and beyond.

Wholesale and retail

The prevailing high prices for consumables and high interest rates are expected to continue exerting a downward pressure on consumer spending in 2024.

The sector is, however, expected to perform better in the medium term as construction activities linked to oil mining and green hydrogen projects gain momentum.

Financial services

We anticipate a continuation of moderate growth for the sector throughout 2024.

This projection is underpinned by the expected sustained positive momentum in total deposits and private claims.

As economic conditions stabilise, it is envisaged that the banking sector will play a pivotal role in facilitating financial activities and contributing to overall economic growth.

SIT ASB IN ‘n KASSIE

Key risks to the positive domestic outlook include:

• Fluctuations in commodity prices

• Uncertainties related to elections

• A possible recession in the South African economy

• Continued uncertainty over the investment environment

• Slow progress on power generation

• Growing debt

• Global developments

• High cost of living

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen