Capricorn: Covid consumes millions in profit

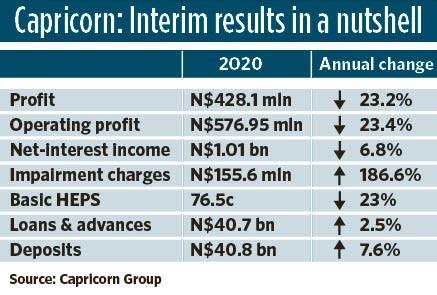

At the end of 2020, Capricorn Group’s non-performing loans reached N$2.2 billion, up 12.7% compared to the six months ended 31 December 2019.

Jo-Maré Duddy – An increase of more than N$100 million in impairment charges and a N$41-million loss suffered by Cavmont Bank in Zambia shrunk Capricorn Group’s profit for the six months ended 31 December 2020 by about 23% compared to the same half-year in 2019.

The locally-list group, which includes Bank Windhoek, yesterday reported a profit of about N$428.1 million for the six months under review, a drop of around N$129.1 million year-on-year.

The group’s profit from continuing operations decreased by N$118.8 million, or 20.2%, relative to the pre-Covid-19 comparable period. Capricorn concluded the sale of Cavmont Bank in January 2020.

Releasing its interim financial results on the Namibian Stock Exchange (NSX), Capricorn said the nearly 187%-increase in its impairment provisions “resulted from the extremely challenging economic and market conditions in the wake of imposed lockdowns and other responses to the pandemic”.

The group provided for impairment charges of more than N$155.6 million in its latest half-year results, compared to nearly N$54.3 million in the corresponding six months in 2019.

NPLs, INTEREST

Capricorn, whose subsidiaries include the local lender Entrepo and Bank Gaberone in Botswana, said its non-performing loans (NPLs) increased by 12.7% year-on-year (y/y) to N$2.2 billion. A loan is regarded as an NPL when the borrower hasn’t made payments on the interest or principal debt for more than 90 days.

The group’s NPL ratio rose from 4.7% to 5.2% during the period under review, against the industry benchmark of 3%. “Due to the significant increase in provision for expected credit losses the NPL coverage ratio increased to 53.2% (December 2019: 44.8%),” Capricorn said.

The group reported net interest income of nearly N$856.6 million, a drop of 17% from the N$1.03 billion in its 2019 book-year.

“Net interest income and interest margins were negatively impacted during 2020 following significant interest rate cuts of 275 basis points by Bank of Namibia and 100 basis points by Bank of Botswana,” Capricorn said in a statement.

The group added: “Despite the interest rate cuts, net interest margin reductions of Bank Windhoek and Bank Gaborone were well contained at only 0.53% and 0.38% y/y respectively. This was achieved mainly through effective management of cost of funding. Entrepo had seen growth of 26.9% in net interest income.”

INCOME, EXPENSES

Non-interest income increased by 3.2% y/y to nearly N$706.4 million. This was achieved “despite the difficult operating environment and the material impact of the Covid-19 preventative regulations on financial activities across the regions where we operate,” Capricorn said.

The group attributed the growth mainly to a 5.6% increase in income from electronic channels and asset management fee income increasing by 13% to N$77.4 million. “This achievement highlights the positive impact of the group’s diversification strategy in cushioning the impact of the steep interest rate cuts experienced,” Capricorn said.

Growth in income from electronic channels and asset management fees were offset by a decline of 22.7% in trading revenue, it added.

Capricorn’s expenses were just above N$986 million, up 2.4% from the same half-year in 2019.

“Roughly 80% of the group’s operating expenses are fixed and could not be adjusted in line with lower expected income since the onset of the pandemic. In addition, a significant part of the group’s technology costs, which increased by 21.5% year-on-year, are denominated in US dollar and was severely impacted by a weakening of the Namibian dollar against the US dollar,” it said.

LOAN BOOK

Capricorn’s gross loans and advances increased by 1.8% to N$41.8 billion during the past half-year.

According to the group, Bank Windhoek’s gross advances increased by 4.8% to N$34.7 billion, exceeding annualised private sector credit extension growth of 2.0%. “The growth was mainly attributable to commercial loans, overdrafts and mortgage loans reflecting how the bank supported the local economy,” Capricorn said.

Bank Gaborone increased gross advances by 2.3% to 4.8 billion pula. “Due to a deterioration of the pula, its loans and advances decreased by 4.7% in Namibian dollar terms,” Capricorn said. Entrepo’s loan book increased by 10.6%.

Capricorn said it remained well capitalised with a total risk-based capital adequacy ratio of 14.1%, well above the minimum regulatory capital requirement of 10%. “The strong capital position will stand the group in good stead whilst navigating the perfect storm brought about by the Covid-19 economic shock,” it added.

The group declared an interim dividend of 22c per ordinary share. The interim dividend per share for the period under review is 10% higher than the final dividend per share of 20c declared during September 2020.

Capricorn is listed on the Local Index of the NSX. It closed Wednesday at N$10.12 per share. It ended last year at N$12.97 per share.

On Wednesday, Capricorn’s market capitalisation by total shares in issue was N$5.254 billion, making it the third biggest company on the Local Index after FirstRand Namibia (N$6.173 billion) and Namibia Breweries (N$6.404 billion).

The locally-list group, which includes Bank Windhoek, yesterday reported a profit of about N$428.1 million for the six months under review, a drop of around N$129.1 million year-on-year.

The group’s profit from continuing operations decreased by N$118.8 million, or 20.2%, relative to the pre-Covid-19 comparable period. Capricorn concluded the sale of Cavmont Bank in January 2020.

Releasing its interim financial results on the Namibian Stock Exchange (NSX), Capricorn said the nearly 187%-increase in its impairment provisions “resulted from the extremely challenging economic and market conditions in the wake of imposed lockdowns and other responses to the pandemic”.

The group provided for impairment charges of more than N$155.6 million in its latest half-year results, compared to nearly N$54.3 million in the corresponding six months in 2019.

NPLs, INTEREST

Capricorn, whose subsidiaries include the local lender Entrepo and Bank Gaberone in Botswana, said its non-performing loans (NPLs) increased by 12.7% year-on-year (y/y) to N$2.2 billion. A loan is regarded as an NPL when the borrower hasn’t made payments on the interest or principal debt for more than 90 days.

The group’s NPL ratio rose from 4.7% to 5.2% during the period under review, against the industry benchmark of 3%. “Due to the significant increase in provision for expected credit losses the NPL coverage ratio increased to 53.2% (December 2019: 44.8%),” Capricorn said.

The group reported net interest income of nearly N$856.6 million, a drop of 17% from the N$1.03 billion in its 2019 book-year.

“Net interest income and interest margins were negatively impacted during 2020 following significant interest rate cuts of 275 basis points by Bank of Namibia and 100 basis points by Bank of Botswana,” Capricorn said in a statement.

The group added: “Despite the interest rate cuts, net interest margin reductions of Bank Windhoek and Bank Gaborone were well contained at only 0.53% and 0.38% y/y respectively. This was achieved mainly through effective management of cost of funding. Entrepo had seen growth of 26.9% in net interest income.”

INCOME, EXPENSES

Non-interest income increased by 3.2% y/y to nearly N$706.4 million. This was achieved “despite the difficult operating environment and the material impact of the Covid-19 preventative regulations on financial activities across the regions where we operate,” Capricorn said.

The group attributed the growth mainly to a 5.6% increase in income from electronic channels and asset management fee income increasing by 13% to N$77.4 million. “This achievement highlights the positive impact of the group’s diversification strategy in cushioning the impact of the steep interest rate cuts experienced,” Capricorn said.

Growth in income from electronic channels and asset management fees were offset by a decline of 22.7% in trading revenue, it added.

Capricorn’s expenses were just above N$986 million, up 2.4% from the same half-year in 2019.

“Roughly 80% of the group’s operating expenses are fixed and could not be adjusted in line with lower expected income since the onset of the pandemic. In addition, a significant part of the group’s technology costs, which increased by 21.5% year-on-year, are denominated in US dollar and was severely impacted by a weakening of the Namibian dollar against the US dollar,” it said.

LOAN BOOK

Capricorn’s gross loans and advances increased by 1.8% to N$41.8 billion during the past half-year.

According to the group, Bank Windhoek’s gross advances increased by 4.8% to N$34.7 billion, exceeding annualised private sector credit extension growth of 2.0%. “The growth was mainly attributable to commercial loans, overdrafts and mortgage loans reflecting how the bank supported the local economy,” Capricorn said.

Bank Gaborone increased gross advances by 2.3% to 4.8 billion pula. “Due to a deterioration of the pula, its loans and advances decreased by 4.7% in Namibian dollar terms,” Capricorn said. Entrepo’s loan book increased by 10.6%.

Capricorn said it remained well capitalised with a total risk-based capital adequacy ratio of 14.1%, well above the minimum regulatory capital requirement of 10%. “The strong capital position will stand the group in good stead whilst navigating the perfect storm brought about by the Covid-19 economic shock,” it added.

The group declared an interim dividend of 22c per ordinary share. The interim dividend per share for the period under review is 10% higher than the final dividend per share of 20c declared during September 2020.

Capricorn is listed on the Local Index of the NSX. It closed Wednesday at N$10.12 per share. It ended last year at N$12.97 per share.

On Wednesday, Capricorn’s market capitalisation by total shares in issue was N$5.254 billion, making it the third biggest company on the Local Index after FirstRand Namibia (N$6.173 billion) and Namibia Breweries (N$6.404 billion).

Kommentar

Allgemeine Zeitung

Zu diesem Artikel wurden keine Kommentare hinterlassen